Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of online?

The purpose of online is to provide access to digital information, services, and resources through the internet. It is used to facilitate communication, collaboration, and convenience, as well as to facilitate commerce, entertainment, education, and other activities.

Online refers to a state or condition of being connected to or accessible via the internet or a computer network. When something is online, it means that it is available or accessible through the internet. This term is commonly used to describe activities, services, resources, or information that can be accessed or used through a web browser, mobile app, or other internet-connected devices. Examples of online activities include browsing websites, shopping, socializing on social media platforms, streaming videos, accessing online banking services, and more.

Who is required to file online?

The requirements for filing online vary depending on the jurisdiction and the type of taxpayer. Generally, individuals, businesses, and organizations that meet certain criteria are required to file their tax returns online. These criteria may include factors such as income levels, types of income, deductions, credits, and existing online filing systems in place. It is best to consult with the specific tax authority in your jurisdiction to determine if you are required to file online.

To fill out an online form, follow these steps:

1. Open the online form: Visit the website or platform that provides the form you need to fill out.

2. Review the form: Take a quick look at the entire form to understand the information required and any specific instructions.

3. Click on the first field: Use your mouse cursor to click on the first blank field where you need to enter information. Sometimes, the field will automatically be selected when you open the form.

4. Start typing: Once the cursor is in the desired field, start typing the required information.

5. Move to the next field: Press the Tab key on your keyboard to move to the next field. Repeat this process for each field you need to fill out in consecutive order.

6. Select options: If the form includes drop-down menus or radio buttons, click on the appropriate option to make your selection.

7. Checkboxes: If there are checkboxes, click on them to mark them. In some cases, you may need to double-click to check or uncheck a box.

8. Upload files: If the form requires you to upload files (e.g., documents, photos, etc.), there is usually a "browse" or "upload" button. Click on it, locate the file on your computer, and select it for upload.

9. Review your entries: After completing all the fields, review your entries to ensure accuracy and completeness. Make any necessary corrections.

10. Submit the form: If there is a "submit" or "next" button, click on it to finalize your form submission. Some forms may require you to complete a security step (e.g., solving a captcha) before submission.

11. Confirmation: Once submitted, you may receive a confirmation message or be redirected to a confirmation page. Take note of any reference numbers or confirmation details provided.

Remember to save a copy of the filled-out form for your records, if applicable.

What information must be reported on online?

The information that must be reported online can vary depending on the context and applicable laws. However, some common types of information that may require reporting include:

1. User-generated content: Online platforms often require reporting of any content that violates their terms of service, such as hate speech, harassment, or explicit content.

2. Cybersecurity incidents: Companies and organizations must report data breaches and other cybersecurity incidents that compromise personal or sensitive information.

3. Online crimes or illegal activities: Reporting may be necessary for online crimes such as hacking, fraud, child exploitation, or distribution of illegal substances.

4. Suspicious or harmful content: Platforms may require reporting of content that promotes self-harm, suicide, violence, terrorism, or any other form of harmful behavior.

5. Copyright infringement: Reporting may be necessary for online copyright violations, such as unauthorized distribution of copyrighted material.

6. Online scams or phishing: Reporting is often encouraged for scams, phishing attempts, or fraudulent activities aiming to deceive users and extract personal or financial information.

7. Vulnerabilities and bugs: Responsible disclosure of software vulnerabilities and bugs to the relevant developers or organizations is often encouraged for the sake of cybersecurity.

It is important to familiarize oneself with the policies and reporting mechanisms established by specific online platforms, as they may have specific requirements and processes for reporting certain types of information.

When is the deadline to file online in 2023?

The deadline to file taxes online in 2023 may vary depending on the jurisdiction and the specific tax return being filed. Therefore, it is recommended to check with the tax authorities in your country or region for the exact deadline. In the United States, for example, the deadline to file federal income tax returns is typically April 15th, but it can be extended to a later date in some cases.

What is the penalty for the late filing of online?

The penalties for late filing of various online activities can vary depending on the specific jurisdiction and the nature of the filing. Here are a few examples:

1. Late filing of taxes: In the United States, if you fail to file your taxes by the deadline, you may face a penalty of 5% of the unpaid taxes each month, up to a maximum of 25% of the total tax amount owed.

2. Late filing of annual reports or financial statements: Many countries and states require businesses to file annual reports or financial statements within a specified period. Failure to file such reports on time may result in penalties, which can vary based on the jurisdiction and the organization's size.

3. Late filing of regulatory compliance documents: For certain industries or professional certifications, individuals or organizations may be required to file various compliance documents within a specific timeframe. Failing to meet these deadlines can result in penalties or the suspension/revocation of licenses or certifications.

It is important to check the specific rules and regulations of your jurisdiction or the platform through which you are filing to determine the exact penalties for late filing.

Can I create an electronic signature for signing my online in Gmail?

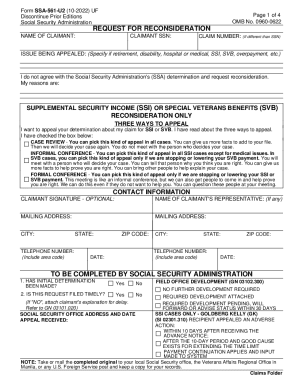

You may quickly make your eSignature using pdfFiller and then eSign your ssa 561 u2 form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the ssa 561 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign ssa 561 u2 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete online on an Android device?

Use the pdfFiller Android app to finish your www socialsecurity gov online form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.